Polyurethane market size, trends, and demand analysis to 2032

The global polyurethane (PU) market size will be USD 86.34 billion in 2022, with revenue expected to grow at a compound annual growth rate of 6.5% during the forecast period. Polyurethane is increasingly used in the automotive industry, and the demand for foam in the furniture industry continues to grow. Driving market revenue growth and high demand for building insulation materials based on sustainability considerations are some of the major factors driving polyurethane market revenue growth.

Polyurethane Market Drivers

The increasing use of polyurethane in the automotive industry is driving the revenue growth of the polyurethane (PU) market during the forecast period. Polyurethane (PU) foam offers automakers the ability to create seats that can be effortlessly assembled, disassembled and recycled. Additionally, it caters to the highest performance specifications for extensive robustness without adding weight to the vehicle.

Polyurethane (PU) foam retains its original shape, durability and resilience even after years of service and heavy-duty service, even with heavy use. Head restraints, armrests and cushioned dashboard, as well as other parts of the car interior, are produced from polyurethane foam.

In the construction industry, polyurethanes are widely used to create high-performance products with properties such as lightweight, functional strength, efficient performance and durability. In addition, these products improve the visual appearance of homes and buildings. Furniture and carpeting are one of the most popular applications of polyurethane. These products are fully cured before sale. According to the U.S. Environmental Protection Agency (EPA), fully cured polyurethane (PU) products are considered inert and nontoxic.

Polyurethane (PU) market restrictions

The implementation of new bio-based polyurethane raw materials and crude oil price fluctuations in polyurethane (PU) are expected to restrain market revenue growth. The fluctuation in crude oil prices is a key component of traditional polyurethane production, bringing uncertainty and insecurity to the overall cost structure of polyurethane manufacturing. Predictive. This may create challenges in cost management and pricing strategies for market participants, which may result in slower market revenue growth.

Polyurethane (PU) Market Segment Insights

Polyurethane Product Type Insights:

On the basis of product, the global polyurethane market is segmented into hard foam, soft foam, coatings, adhesives and sealants, elastomers, and others.

The rigid foam segment will hold the largest revenue share in 2022. Rigid foam is highly sought after across various industries due to its structural stability, which allows manufacturers to create insulation products. These foams can have sound insulation properties, heat resistance and high mechanical strength, making them suitable for use in extreme weather conditions and rough environments.

Expanding construction and furniture industries and presence of major automotive original equipment manufacturers (EMs) are the key factors driving the growth of the rigid foam segment. Additionally, increasing government support for strengthening low-income households against harsh weather conditions and meeting transitional standards for green buildings is expected to further create high demand for rigid foam over the forecast period.

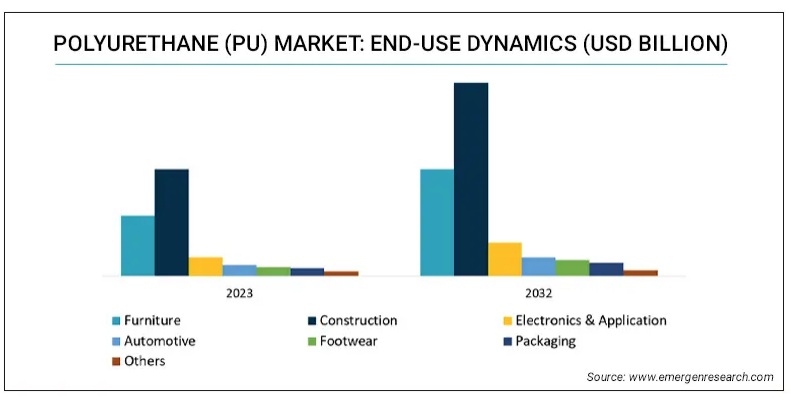

Polyurethane end use:

On the basis of end use, the global polyurethane market is segmented into furniture, construction, electronics and appliances, automotive, footwear, packaging, and others.

The furniture segment is expected to account for the largest revenue share during the forecast period. This growth can be attributed to several factors, including versatility of polyurethane as a material for furniture production, comfort, durability, aesthetic appeal, and cost-effectiveness. , polyurethane (PU) can be molded into a variety of forms, making it ideal for making cushions, padding, coatings and even structural components in furniture. Additionally, advancements in environmentally friendly formulations and regulatory compliance have further strengthened polyurethane’s position in the furniture industry. These factors are helping to increase the application of polyurethane (PU) in the furniture segment and are expected to drive revenue growth in this segment during the forecast period.

Polyurethane (PU) Regional Insights:

Polyurethane Asia Pacific Market

Based on regional analysis, the Asia-Pacific market held the largest revenue share in 2022 and revenue is expected to maintain a stable CAGR during the forecast period.

The Asia-Pacific market is currently experiencing significant growth and is expected to continue growing rapidly during the forecast period. This growth was primarily driven by expansion in key end-use industries such as appliances, packaging, automotive, electronics, furniture, interiors and construction. The region benefits from a large and low-cost skilled workforce, as well as easy access to land. In particular, the construction, electronics, and automotive industries are expanding rapidly, providing growth opportunities for polyurethane (PU) manufacturers.

Urbanization and industrialization in countries including India and China, as well as the infrastructure framework in the Middle East, are expected to further drive the construction industry. Furthermore, government initiatives such as smart cities and foreign direct investment in the construction and development sector are boosting the growth of the construction sector and the increasing popularity of green buildings. The global construction industry is also expected to increase the demand for the polyurethane market over the forecast period.

Polyurethane European market

The European market is expected to hold the third largest revenue share and register a significantly high revenue CAGR during the forecast period. The growth of the furniture and construction industry in Europe can be attributed to stringent regulatory frameworks aimed at reducing greenhouse gas emissions, which has led to increased investments in rigid polyurethane (PU) foam by automotive manufacturers in the region.

Demand for rigid polyurethane foam is also increasing in Mexico on account of growing residential construction and infrastructure activities. In September 2022, Saint-Gobain received all necessary approvals to acquire GCP Applied Technologies, a company specializing in European construction chemicals. This acquisition helps Saint-Gobain gain greater recognition in the construction chemicals segment during the forecast period.

Polyurethane North American market

The North American market accounted for the second-largest revenue share in 2022. Building and construction is expected to be the largest end-user segment.

Increasing use of durable plastics in construction is driving market revenue growth in North America. Competition from polystyrene and polypropylene foam is likely to hinder market revenue growth.

According to the U.S. Department of Energy, heating and cooling account for 55% of the energy used in a typical U.S. home. It is the largest energy expense for many homes. To maintain even temperatures and lower noise levels in homes and commercial properties, builders turn to Use rigid polyurethane (PU) and polyisocyanurate foam. The application of polyurethane foam in the construction industry is expected to drive revenue growth in the North American market.